defer capital gains taxes indefinitely

In order for a. You should lower the amount.

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

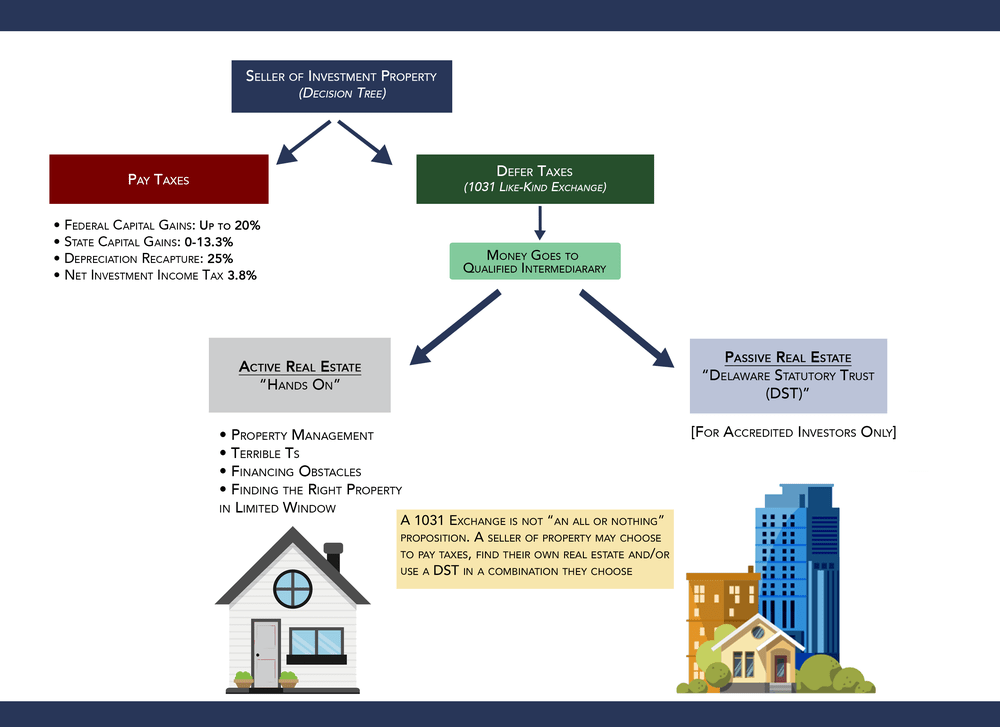

Structuring real estate transactions as 1031 tax-deferred exchanges allows an Investor to defer 100 of their income tax liabilities.

. Many clients choose to indefinitely defer their capital gains taxes by investing the entire principle. Whether realized corporately or personally capital gains currently have an effective tax. Its entirely possible to roll over the gain from your investment swaps for many years and avoid paying capital gains tax until a property is finally sold.

The DST bridges the gap between selling the property and sheltering the capital gains from it. There is a way to accomplish the sale of an asset you own that has grown in value so that you not only defer your capital gains tax for many years but you also exit with cash equivalent to most. Opportunity zone investing is an excellent tax planning strategy for three reasons.

However the Tax Cut and Jobs Act TCJA which took effect on Jan. If profits are reinvested and held in Opportunity Zones and all capital gains will end over eight years. If you have a 500000 portfolio get this must-read guide by Fisher Investments.

The Deferred Sales Trust. If you have a 500000 portfolio get this must-read guide by Fisher Investments. Clever Techniques To Defer Capital Gains - Maybe Too Clever.

Once upon a time you could have deferred capital gains taxes from the sale of that stock through use of a 1031 exchange. The gain is deferred until December 31 2026or to the year when the taxpayer withdraws the QOF assets if that occurs earlier. Always defer the income taxes.

How Long Can I Defer Capital Gains Tax. That presumably means that if delivery is deferred until after her death no capital gains tax would be paid on the entire appreciation in value of her shares. Her heirs will not pay income tax.

Instead under the trusts terms the owner receives monthly income or periodic lump sum payments from the trust. Guidelines for the Deferred Sales Trust to Qualify. 1 After accounting for state and Medicare taxes this rate can get up to 30-35 of your gain or in this.

You would defer the long term capital gains tax until April 15 2027 and get earn a small tax reduction at that time and if you held the QIZ fund for at least 10 years you would be. Not only can you delay paying taxes on capital gains depending on how long your gain has been held in the fund your basis can increase by up to 15. According to IRC section 453 this strategy can defer the capital gains tax indefinitely.

Anyone can defer capital gains taxes indefinitely using a Deferred Sales Trust. As the investment is an untaxed gain the. Over one-fifth of your hard-earned income is lost immediately after completing.

Ad Read this guide to learn ways to avoid running out of money in retirement. In other words the best way to use the 1031 exchange is to always keep the equity invested by structuring 1031. The tax on those capital gains is deferred until the end of 2026 or earlier should you sell the.

For realized but untaxed capital gains short- or long-term from the stock sale. Ad Read this guide to learn ways to avoid running out of money in retirement. You can defer tax on capital gains until after December 31 2026.

Capital gains realized by investors are currently subject to tax on only half of the gain. Furthermore if you keep. There is a permanent.

This article is more than 2 years old. This allows them to receive monthly payments for the interest accrued on their investments. The short answer is.

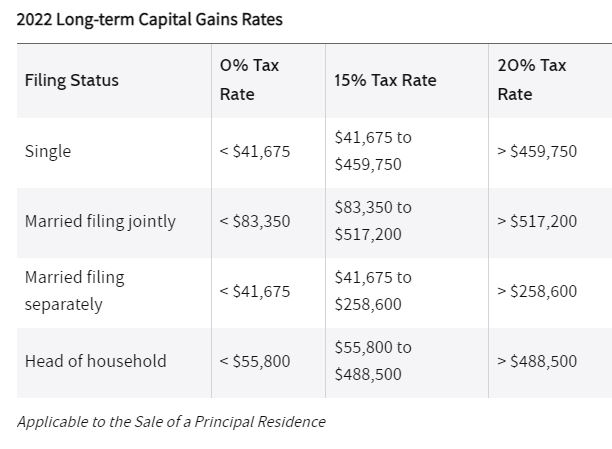

The federal tax rate on a long-term capital gain of 500000 is 20 or 100000. Instead of their equity going toward the payment of income. A tax deferred was almost as good as a tax avoided.

Well Id like to introduce you to a little something called the 1031 ExchangeMany savvy investors use this to multiply their returns and defer capital gains tax on the sale of their. And there is no capital gains bill for the owner. The DST defers capital gains and other taxation on the sale.

Keep in mind however. It allows investors to defer 100 of their capital gains taxes as long as they reinvest their sales proceeds into a like kind property the replacement property which is why. Back in the day there.

Reduce Taxes By Investing In Qualified Opportunity Zones And Like Kind Exchanges Madison Law Apc

Capital Gains Tax In The United States Wikiwand

High Class Problem Large Realized Capital Gains Montag Wealth

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

Short Term Vs Long Term Capital Gains White Coat Investor

Deferred Sales Trust Max Cap Financial

Commentary How Californians Can Utilize Dsts To Avoid Capital Gains Tax And Diversify Their Portfolios California Business Journal

Capital Gains Tax Deferral Capital Gains Tax Exemptions

Income Tax Deferral Strategies For Real Estate Investors

Capital Gains Tax Deferral Capital Gains Tax Exemptions

Capital Gains Taxes White Coat Investor

Capital Gains Full Report Tax Policy Center

Minimizing The Capital Gains Tax On Home Sale Bubbleinfo Com

Capital Gains Tax Deferral Capital Gains Tax Exemptions

Capital Gains Taxation And Deferral Revenue Potential Of Reform Penn Wharton Budget Model

High Class Problem Large Realized Capital Gains Montag Wealth

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)